Best Betting Sites in Uganda

The number of online gambling sites in Uganda is growing steadily. The main reason for this growth is that Ugandan betting customers are demanding better service from their bookmakers – and they’re getting it. Many of the betting companies in Uganda also offer their services as casinos. Тhere are a few sites that have stood the test of time, especially for Uganda betting market. Our page covers these tried-and-true options so you can use them as your go-to places for all things related to gambling on sports or casino in Uganda.

Where to bet safely in Uganda?

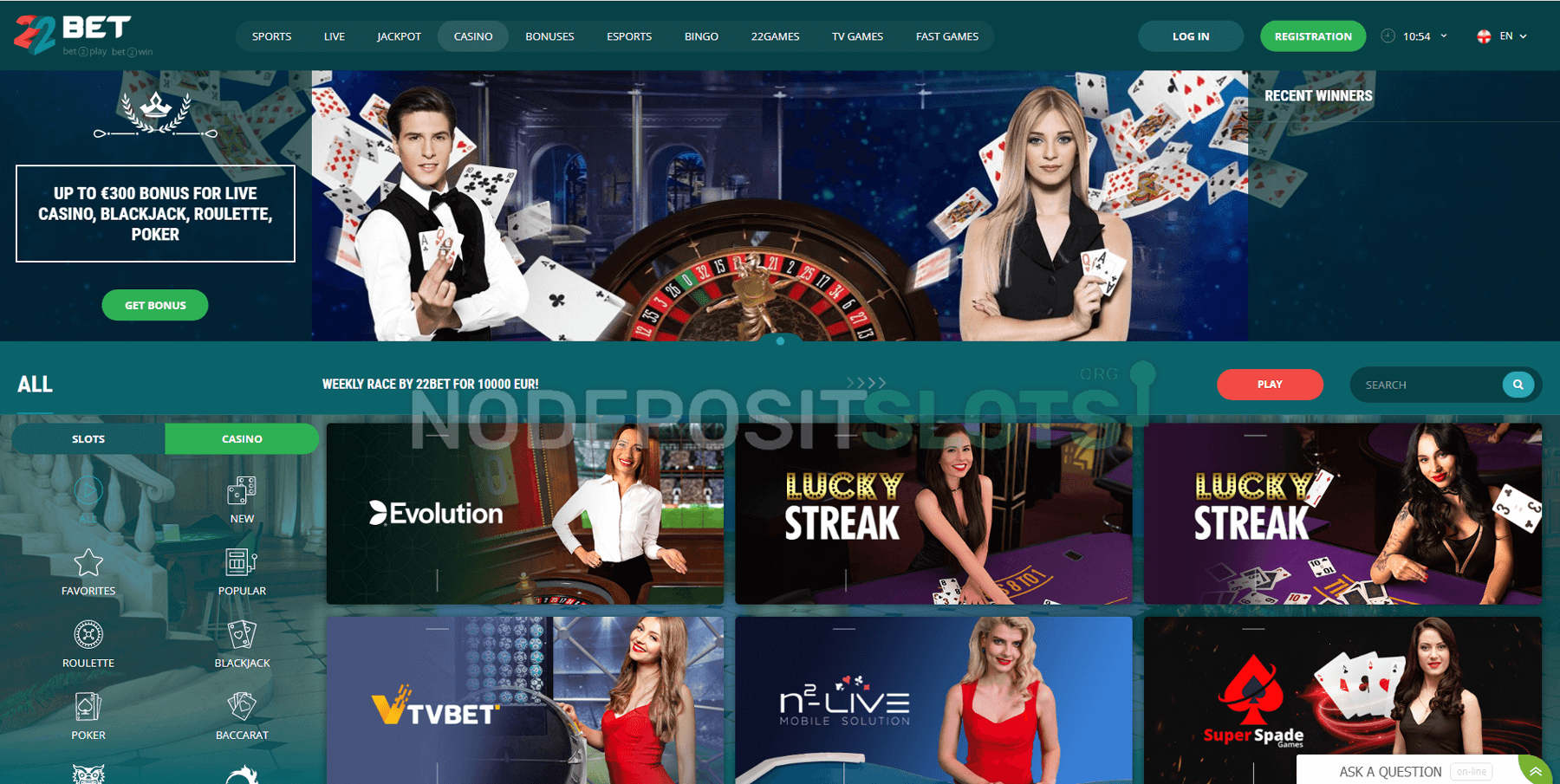

Best Online Betting companies in Uganda Listed:| Welcome OfferWelcome Bonus up to €300

Rating: 4.2 | 22bet is a leading sports betting site in Uganda, offering streaming of live sporting events as well as bet placing. + Show More Positives

Negatives

| |

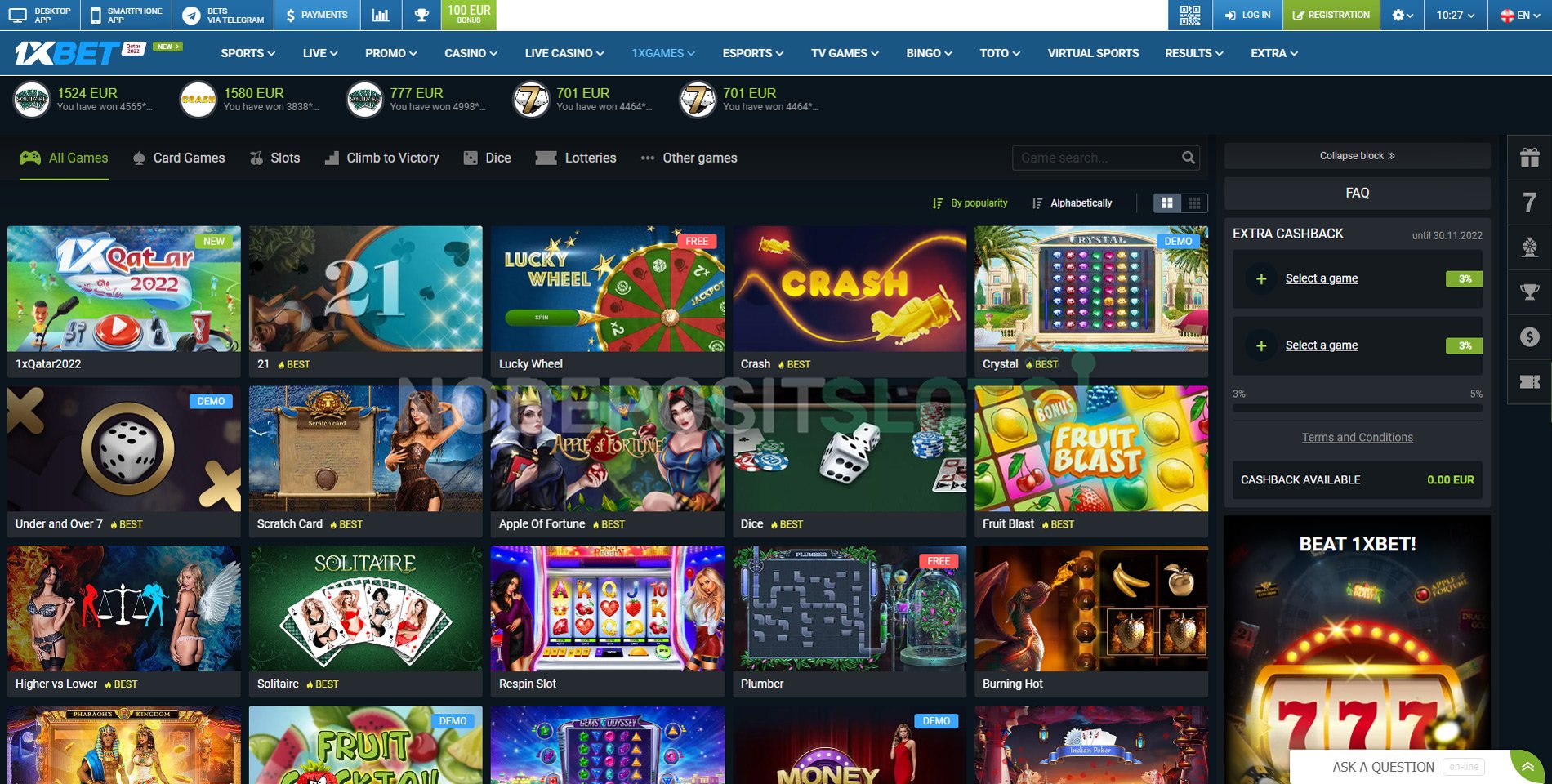

| Welcome Offer€1500 + 150 Free Spins

Rating: 3.8 | 1xbet is a Russian company that has been in operation since 2007, and they've gained popularity among African punters over the years. They offer great odds, betting options and customer support. + Show More Positives

Negatives

| |

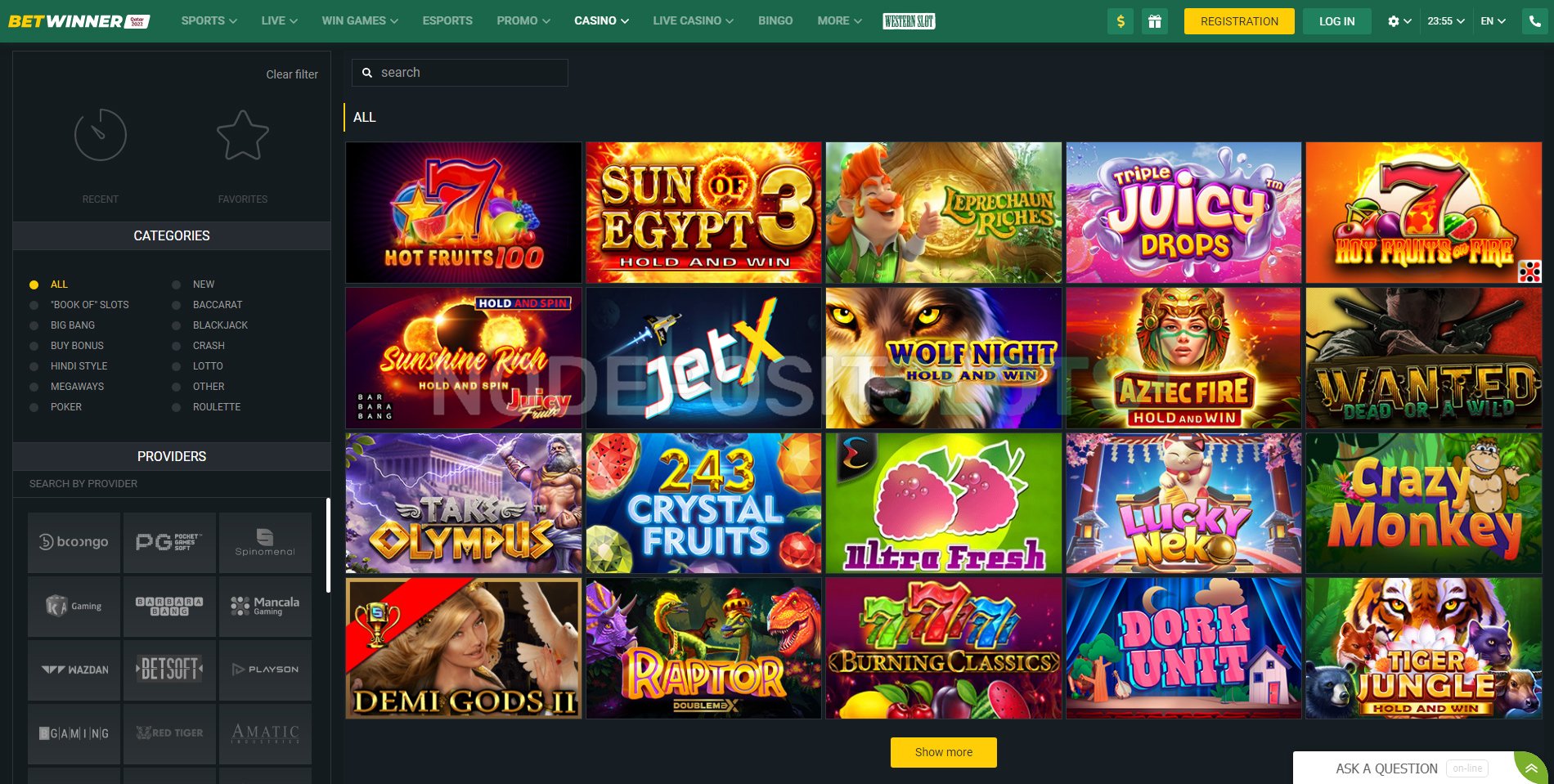

| Welcome Offer100% bonus up to €130

Rating: 4.1 | Betwinner was established in 2018 by a group of professional businessmen. The operator has its main office located in Cyprus, Limassol, and holds the required licenses to conduct gambling business from Curacao regulator. + Show More Positives

Negatives

| |

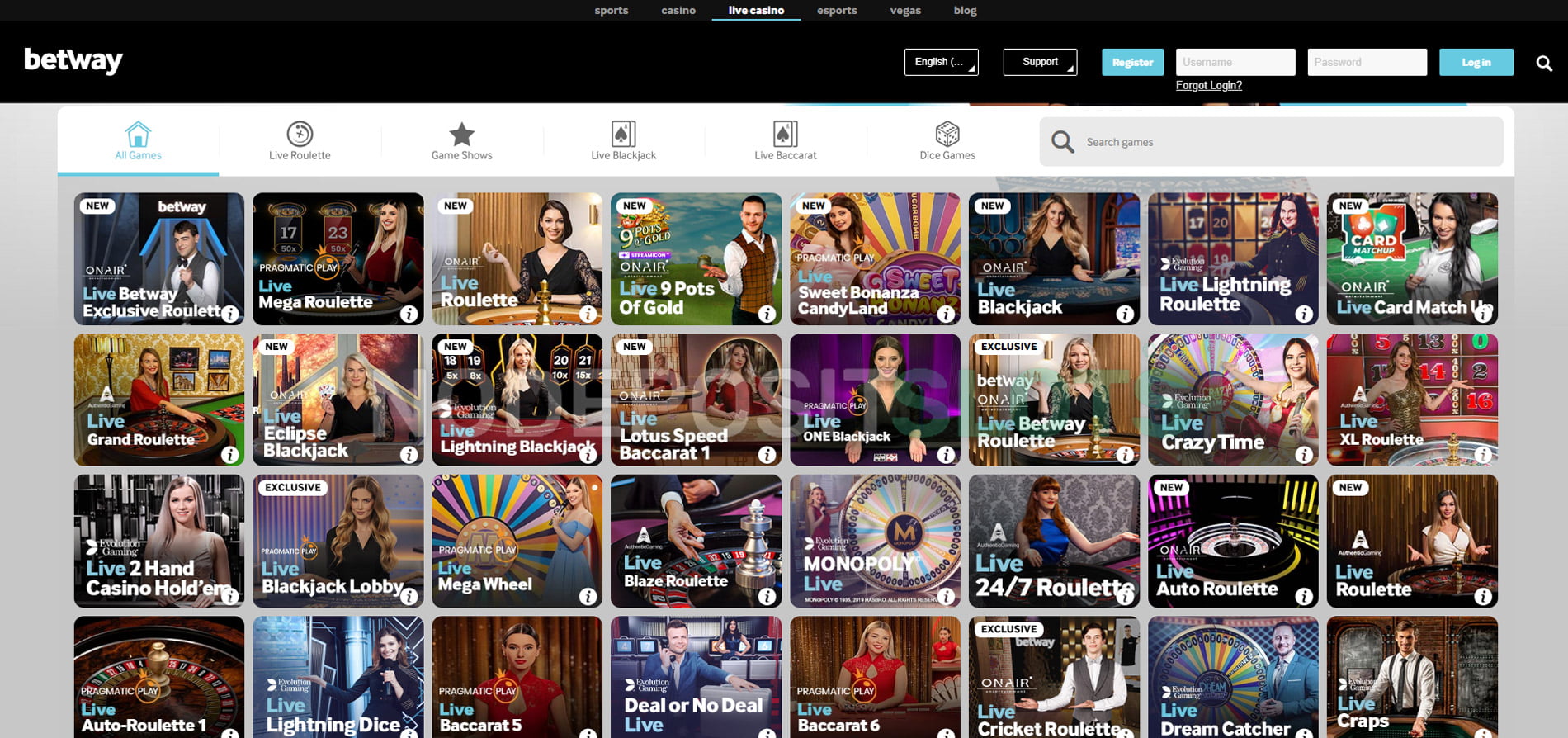

| Welcome Offer100% up to £50

Rating: 3.6 | In 2006, Betway was founded as an online gambling provider. Their headquarters are in Malta and Guernsey; they're fully licensed and have a very big betting offer that focuses on Africa. + Show More Positives

Negatives

| |

MELbet | Welcome OfferCasino Welcome OfferClaim Bonus | Melbet Uganda was founded in 2020 and acquired a license from the National Lotteries and Gaming Regulatory Board. With its competitive offerings and excellent services, Melbet can be counted among the leading bookmakers in the Ugandan gambling industry. + Show MorePositives

Negatives

|

BetOn | Welcome OfferUGX 100,000 BonusClaim Bonus | Beton is a betting company in Uganda. It offers registration bonuses, live betting and various esports - including the option of depositing with Ugandan shillings or other flexible payment options. + Show MorePositives

Negatives

|

Avoid these websites

- Betpawa

- Bigbetworld

- 1bet

- Riverbet

- Premiumbull

- Betcity

- Skybook

Gambling Laws in Uganda

Sports betting is legal in Uganda as long as it is carried out by a company that has been licensed and regulated by the country’s National Gambling Board (NGBU), as mandated under section 4 of Lotteries and Gaming Act 2016.

The Ugandan gambling regulatory commission, under the Lotteries and Gaming Act 2016, is responsible for issuing licenses to all companies that want to operate in Uganda’s lottery system or casinos. The National Gambling Board of Uganda has the right to supervise, license, enforce laws and dispute management. This is done in order to protect the public from negative effects associated with gambling.

The requirements of the betting companies in uganda to be licensed as betting operator includes:

- Proof of incorporation;

- Security guarantees;

- Physical office;

- Full description of game rules and equipment;

- Details of directors, shareholders and key employees;

- Memorandum and articles of association;

- Verified Bank account

Uganda Sports Betting Markets Available to Uganda Gamblers

People in Uganda seem to love many sports, including football, which dominates among the preferences of the punters. Basketball and volleyball are also popular sports here. Boxing is another one that many people enjoy watching or playing. A greater number of betting choices improves the odds for players who want to partake in multiple events.

Many punters in the country only bet through their mobile devices. This means that users are more likely to appreciate a sports betting platform that offers a good mobile app. Most of the bookies available in this country cover most important sporting events like Champions League, NBA, NFL and others.

Bet Types for Betting Sites in Uganda

In order for online bookmakers to attract more customers, it is important that they provide players with interesting sports promotions and betting options. Bettors enjoy using the betting combinations that are available to them, and they especially like placing bets on their favorite events.

The Ugandan Bookmaker with the Best Odds

The most important aspect of betting at UG sites, for experienced players , is figuring out odds. They know how to create good odds and then calculate them in order make profitable bets. You should also pay attention to the profit margin, which is given by the odds for each sport. The lower the profit margin, the better chance for making a good bet. In this table we have outlined some of Uganda’s bookies with favourable margins on sports events:

| Betting Site | Pre-Match/In-Play | Betting Market | Profit Margin |

|---|---|---|---|

| Betway | Pre Match | England Premier League | 2.60% |

| 22Bet | Pre Match | Champions League | ~5.90% |

| 1XBET | Pre Match | Champions League | ~9.50% |

Popular sports in Uganda

- Football

- Basketball

- Tennis

- Golf

- Volleyball

- Boxing

- Cricket

- Baseball

- Horse Racing

- Snooker

- Table Tennis

- Darts

- MMA

- Badminton

- eSports

- Greyhounds

- Rugby

The sports platforms operating in Uganda are able to meet their customers’ demands, providing live streams and odds for the country’s growing number of bettors.

Gambling Banking in Uganda

Most Ugandan betting sites accept local currencies as payment methods, and registration is quick and easy. In fact, some of these sites have the local payment method embedded onto their platforms for players’ convenience – making it even easier to place bets.

- Debit/Credit card (Mastercard,Visa and etc.)

- Bank Transfer

- E-wallets: Skrill, Neteller, PayPal, Perfect Money and etc.

- Mobile Money

Mobile Money

In Uganda, mobile money such as Airtel Money and MTN money are the most popular. Players can send their funds directly to their betting account by sending an SMS/ shortcode from a phone; network fees may apply. The deposit is immediate.

Debit Cards / Mastercard and Visa

This deposit method is commonly accepted by local and international betting sites. Card transactions are instant and free of charge, with the amount based on limits set by the issuer or betting company.

Bank Transfer

This transaction is a direct transfer of funds from your bank account to the betting site. Several banks in Uganda offer this service, including Citi Bank, Standard Chartered, Stanbic bank and ABSA.

E-wallet

E-wallet deposits such as Skrill, Neteller, PayPal and Perfect Money are accepted by many betting sites.

What kind of no deposit bonuses (free bet offers) are available for Uganda

Ugandan betting sites offer registration bonuses in many forms, but most are easy to claim once a member has signed up. The no deposit bonuses are usually started for very small period of time and are active for 1-2 weeks. Here are some of the kinds of free bets you can take advantage of:

Get a free bet of equal value to your first wager.

Place a bet and get another, bigger free bet based on the initial stake.

Multi-step offers involve placing a series of bets and receiving a free bet at various stages.

If you lose, the bookmaker will credit part of your stake as a free bet.

Deposit bonuses are free funds you’re awarded when making your first deposit. You must meet all of the wagering requirements (playing through a certain amount) before being eligible to withdraw and/or place these bets on real games.

FAQ About Betting in Uganda

What’s the best Uganda sports betting site?

22bet is the best online betting site in Uganda. It offers a welcome bonus of 50% up to 200,000 Uks and has over 50 different markets with incredibly low odds.

How can you place bets at online betting sites in Uganda?

Online betting is just as easy or easier than traditional land-based betting. Search for the sporting events you’d like to bet on, choose your bets, and then place a wager. That’s all there is to it!

Are there any bonus offers for Uganda sports betting players?

Yes, all of the online betting Uganda sites that we recommend to players offer new sign-up bonuses.

Is gambling legal in Uganda?

Until 2016, sports betting was illegal in Uganda. However, a new bill changed the legal situation; it created the National Gaming Board that regulates gaming and gambling activities in the country. Licensing removes a layer of legal red tape, allowing online bookies to operate within the borders of a country.

Where can you find the best odds for Ugandan sports?

Although betting on sports can be enjoyable, the primary motivation for punters is financial gain. Therefore, if you are looking for the site with the best Uganda sports betting odds, 22bet is your best bet. It offers a profit margin of only 2.35%, which is less than half of what most competitors offer.

What payment options do online gambling sites offer?

When making deposits or withdrawals at any of the best online betting sites in Uganda, you will have several payment methods to choose from. These include well-known brands like Airtel and MTN; Visa, Mastercard and Paysafecard are also available – as is Skrill (for international players), Neteller (which accepts a wide range of currency conversions) EcoPayz(another option for exchanges).

Conclusion

When comparing betting sites, it’s important to consider several different factors. Our bookmaker reviews provide a complete overview of what each site has to offer and how they compare with other online sportsbooks. They include registration, welcome bonus, betting offer, payment methods and security. One way to find out which online betting sites are best suited to you is by reading our bookie reviews.